Choosing your CPA subjects can be tricky. We often get asked:

‘What order should I do my CPA subjects in?’ and

‘What CPA subject electives should I choose?’,

__________________________________________________________________________________

We recommend that you complete the compulsory core subjects first then complete your electives.

| Order | Subject |

|---|---|

| 1st | Ethics & Governance (EG) |

| 2nd | Strategic Management Accounting (SMA) |

| 3rd | Financial Reporting (FR) |

| 4th | Global Strategy and Leadership (GSL) |

| 5th | Elective 1 |

| 6th | Elective 2 |

CPA Subject choice tips

– Don’t leave FR until last, even though it is really tough. If you get stuck on FR you want to find out earlier rather than later, so you can decide whether to continue with your studies.– Don’t do AAA before FR; Audit involves careful consideration of IFRS which are covered in FR.

Most people must do the 4 CPA compulsory core subjects plus 2 electives. In this situation you cannot do GSL until you have completed the other 3 compulsory core subjects. Some people are given exemptions. Others have no electives and must do specific subjects as electives.

1. Why start with the compulsory core subjects? There is no point doing electives until you have mastered the core. If you cannot master the core then you cannot complete the program. If you start with electives and only after that attempt the core, you may find out much later that you are not going to continue with your CPA studies due to the difficulty level or other reasons.

2. Why start with Ethics and Governance first? It is the introduction course to becoming a professional accountant. It introduces concepts that are explored further in later subjects. For most people it is also the easiest core subject. So, it is best to start the CPA Program here. This is the time to learn how to study online and without the typical support and structure you get at university level.

3. Why Strategic Management Accounting (SMA) second and Financial Reporting (FR) third? SMA is more difficult than EG but not as hard or time consuming as FR for most people. So, this is the second stage in mastering the CPA Program. Many people find the jump from EG straight to FR too hard. They do not put in enough work and find it very stressful and often fail. So, EG, then SMA then FR is the best progression that supports your successful completion of the program.

4. Why Global Strategy and Leadership (GSL) fourth? Shouldn’t it be last? Theoretically, it should be last. GSL is a capstone subject that brings all your CPA studies together. But, because it is a compulsory core subject, we think it is best to do before your electives. If you cannot make it through this subject there is little benefit in doing the electives as you will not successful complete the CPA Program.

5. Which elective should I choose? Do the subjects that are likely to assist with your future career direction. Getting your accreditation as a CPA is critical but you should have also mapped out some idea of where your next career steps will likely be. There is no ‘easiest’ CPA Subject. They are all hard. So, do not try and choose the CPA elective that is easiest.

Some useful examples:

Public Practice or Technical Accountant: Advanced Audit & Assurance and Australia Taxation. Tax Practitioner: Advanced Audit & Assurance and Australia Taxation (Advanced). and Australia Taxation – Advanced would be the best fit. Accountant in Business / Consulting: Contemporary Business Issues & Digital Finance. Management Accounting / Treasury: Contemporary Business and Financial Risk Management.

Doing Two CPA Subjects or more in a Semester

Please don’t – here is why. https://knowledgequity.com.au/should-i-do-two-cpa-subjects-at-once/

Please don’t – here is why. https://knowledgequity.com.au/should-i-do-two-cpa-subjects-at-once/ CPA Subject choice tips

– Don’t leave FR until last, even though it is really tough. If you get stuck on FR you want to find out earlier rather than later, so you can decide whether to continue with your studies. – Don’t do AAA before FR; Audit involves careful consideration of financial reporting and standards, so you need FR knowledge to do this well. – If you are not sure of your career plans then choose subjects that interest you. Why? Because if you are motivated this generally translates into good results.CPA subject electives

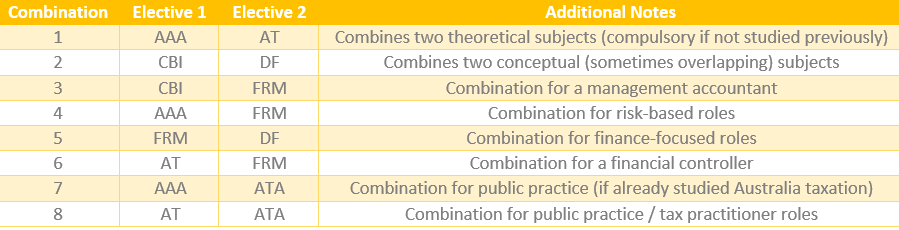

In reality, there are 15 combinations of electives, however here are some common take-ups and recommendations:

- If you have not completed Auditing and Taxation (Australia or local variant) at an under graduate level, these two subjects will be compulsory (combination 1).

- If your preference is for conceptual subjects then combination 2 is ideal (CBI and DF) and if your preference is for theoretical subjects (that is, subjects that have frameworks, standards, law / legislation) then combination 1 is better (AAA and Australia Taxation).

- If you have already taken Australian Taxation at undergraduate level, you may be permitted to take Australia Taxation – Advanced as a standalone elective (combination 7), rather than combining it with Australia Taxation (combination 8).

| CPA Program Subject | Module 1 Free Resources | Facebook Group | YouTube Playlist |

| Ethics & Governance | EG CPA Assist | EG Facebook | EG Videos – Youtube |

| Strategic Management Accounting | SMA CPA Assist | SMA Facebook | SMA Videos – YouTube |

| Financial Reporting | FR CPA Assist | FR Facebook | FR Videos – Youtube |

| Global Strategy and Leadership | GSL CPA Assist | GSL Facebook | GSL Videos – Youtube |

| Advanced Audit & Assurance | AAA CPA Assist | AAA Facebook | AAA Videos – Youtube |

| Australia Taxation | AT CPA Assist | AT & ATA Facebook | AT Videos – Youtube |

| Australia Taxation – Advanced | ATA CPA Assist | AT & ATA Facebook | ATA Videos – Youtube |

| Contemporary Business Issues | CBI CPA Assist | CBI Facebook | CBI Videos – Youtube |

| Digital Finance | DF CPA Assist | DF Facebook | DF Videos – Youtube |

| Financial Risk Management | FRM CPA Assist | FRM Facebook | FRM Videos – Youtube |

Some other things to keep in mind are

- Try not to use previous semester CPA pass rates as a factor to inform your subject selection.

- Try not to be influenced by the opinions of others on the difficulty levels of subjects. This is as what one person finds difficult, another person might find easy.

- If you have deferred or failed a subject, don’t just assume that you can/should take multiple subjects the following semester to ‘catch-up’. You need to make sure you have the time and discipline to get through both subjects – you don’t want to dig yourself into a deeper hole!

- Length of the study guide (for instance number of modules or number of pages) is not always relevant. Some people find it much easier to master technical, rule based content – while others prefer conceptual and narrative based reading.